One Big Beautiful Bill & State And Local Taxes

The Tax Cuts and Jobs Act (TCJA) established an annual $10,000 deduction cap for state and local taxes (SALT) from tax years 2018 through 2025 (inclusive). The One Big Beautiful Bill Act (OBBBA), however, modifies the cap beginning with the 2025 tax year.

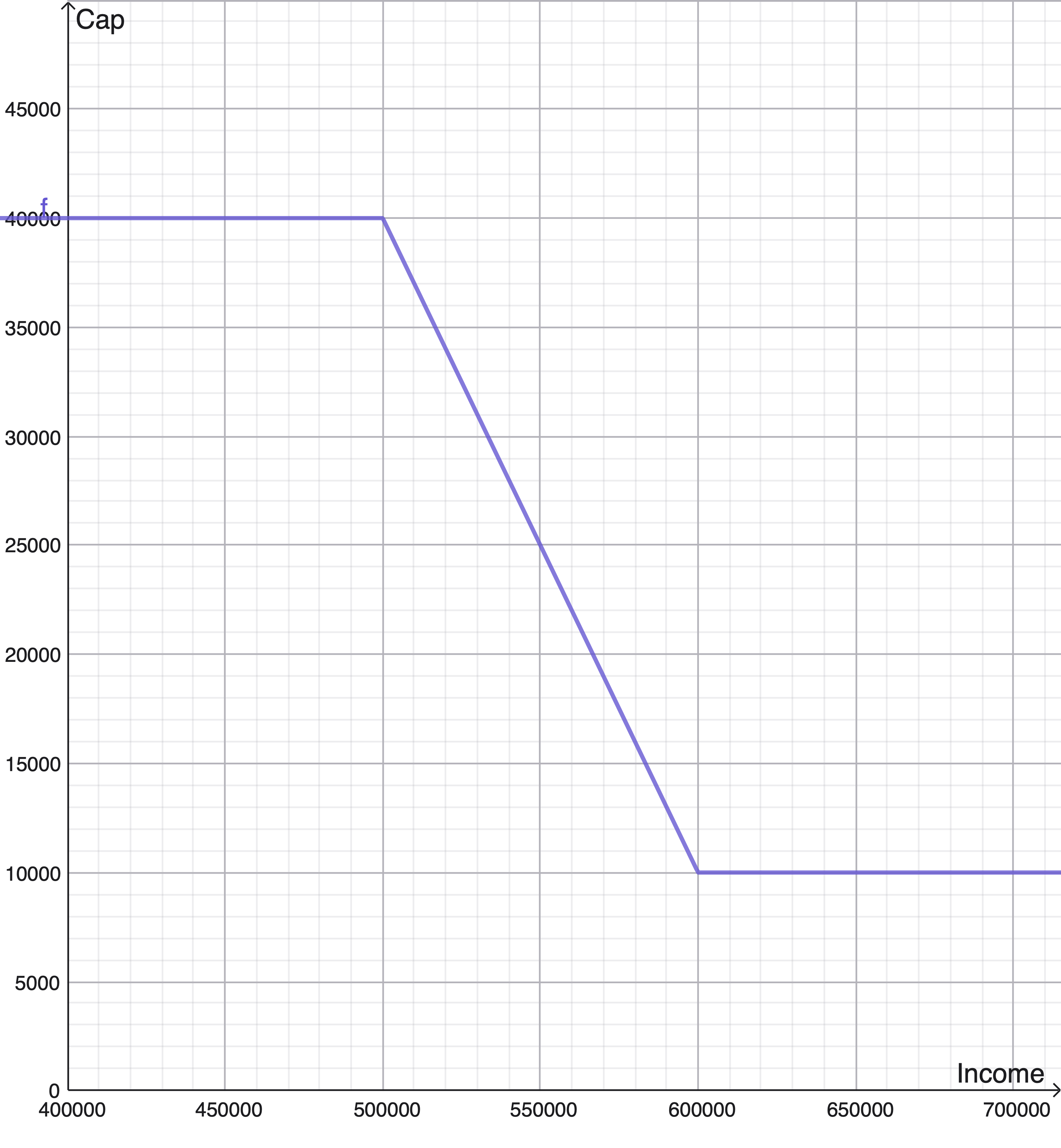

For the year 2025, the new SALT cap (\(y\)), as a function of Modified Adjusted Gross Income or MAGI (\(x\)), can be expressed by:

\[y = \begin{cases} \$40,000 & :\ \$000{,}000 \leq x \lt \$500{,}000 \\ \$40,000 - 0.3(x - \$500{,}000) & :\ \$500{,}000 \leq x \lt \$600{,}000 \\ \$10,000 & :\ \$600{,}000 \leq x \lt \$\infty \end{cases}\]where:

- $40,000 is the base SALT cap for 2025 (except married filing separately, which is $20,000), which increases by 1% annually through 2029. The SALT cap will revert to $10,000 starting with the 2030 tax year.

- $500,000 is the MAGI Threshold for 2025, also subject to the annual 1% increase.

This formula can be visualized as follows:

For 2025, you may claim either the standard deduction or (if larger) your itemized deductions. The standard deduction amounts by filing status are:

- $15,750 for Single or Married Filing Separately

- $23,625 for Head of Household

- $31,500 for Married Filing Jointly or Qualifying Surviving Spouse

Typical itemized deduction items include:

- SALT (subject to the new limitation)

- Mortgage interest on loans up to $750,000 principal

- Charitable donations

Raising the SALT cap under OBBBA will increase the number of filers who benefit from itemizing their deductions, especially for those in high-tax states.

This summary is based on the Pull Request, aka House Bill:

SEC. 70120. LIMITATION ON INDIVIDUAL DEDUCTIONS FOR CERTAIN STATE AND LOCAL TAXES, ETC.

(a) In General.—Section 164(b)(6) is amended—

(1) by striking “and before January 1, 2026”, and

(2) by striking “$10,000 ($5,000 in the case of a married individual filing a separate return)” and inserting “the applicable limitation amount (half the applicable limitation amount in the case of a married individual filing a separate return)”.

…

which merges into IRC §164.