Understanding the IRS Identity Protection PIN (IP PIN)

The Identity Protection PIN (IP PIN) is a valuable tool provided by the IRS to help safeguard your tax identity. If you’re concerned about tax-related identity theft—or simply want an added layer of security—enrolling in the IP PIN program is a proactive step.

What Is an IP PIN?

An Identity Protection PIN (IP PIN) is a six-digit number issued annually by the IRS. It is used to prevent others from filing a tax return using your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) without authorization.

The IP PIN is known only to you and the IRS, and it must be included when you file your federal tax return—whether electronically or on paper.

Why Use an IP PIN?

Using an IP PIN adds an additional layer of protection. Even if you have no filing requirement in a given year, having an IP PIN still protects your account against unauthorized filings or fraudulent refunds.

Some key points:

- The IP PIN is valid for one calendar year only.

- A new IP PIN is issued every January, and can be accessed through your IRS online account.

- You must use the IP PIN for any federal tax return you file during the year—including returns for prior years (e.g., 2022, 2023).

Where to Get an IP PIN

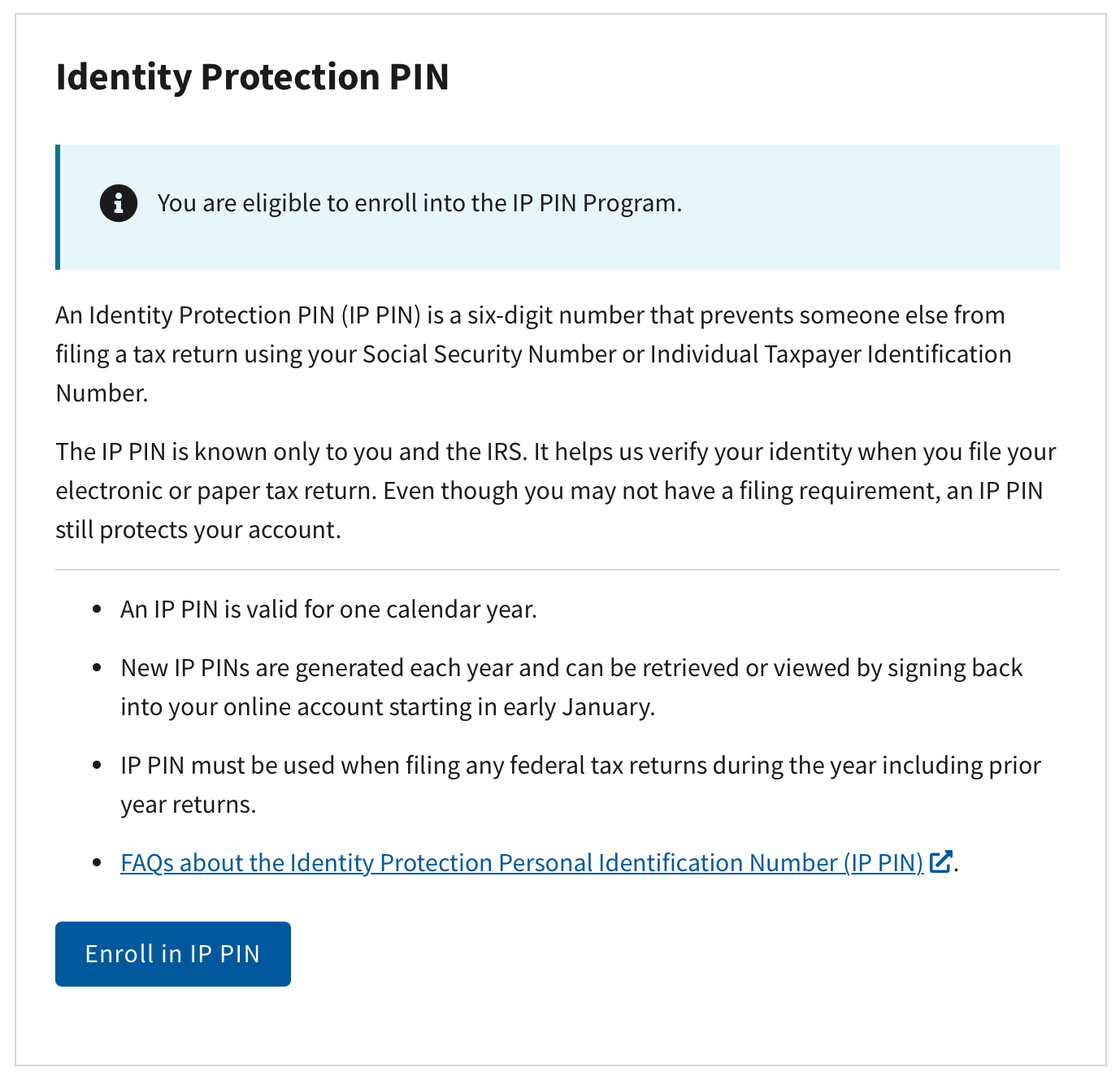

You can obtain your IP PIN by visiting www.irs.gov/getanippin and creating or logging into your IRS online account. Once logged in, you will see a notice like the one below:

Choose Your Enrollment Option

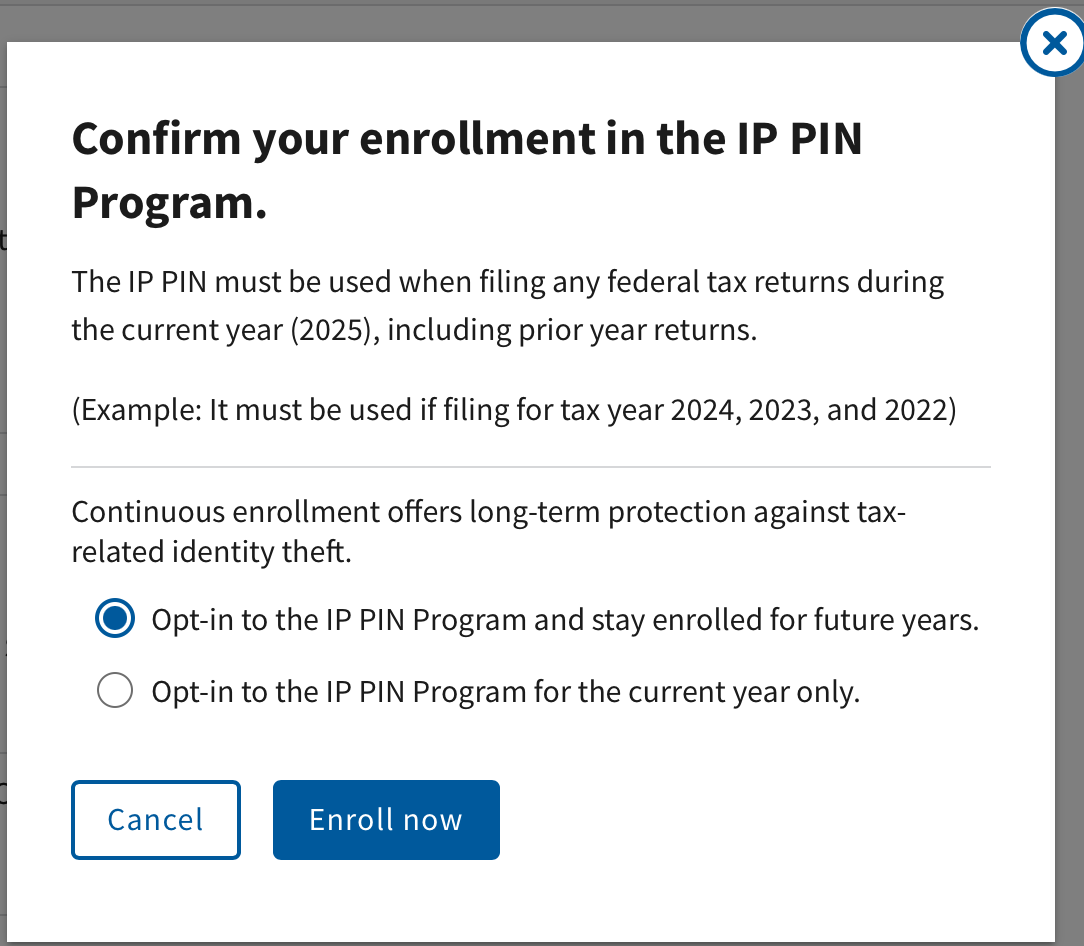

After clicking “Enroll in IP PIN”, you’ll be presented with two options:

- Opt-in for the current year only – Useful if you just want temporary protection.

- Opt-in for future years as well – Recommended if you want ongoing security without re-enrolling every year.

Once enrolled, you must include your IP PIN when filing any federal tax return while it is in effect. This applies to both current and prior-year returns.

Final Note

The IRS takes identity theft seriously, and the IP PIN is one of the most effective tools available to taxpayers. If you’re eligible, consider enrolling—especially if your SSN has ever been compromised or if you’re at high risk for identity fraud. For more information, please read this FAQ.