Overdraft Protection | 透支保护

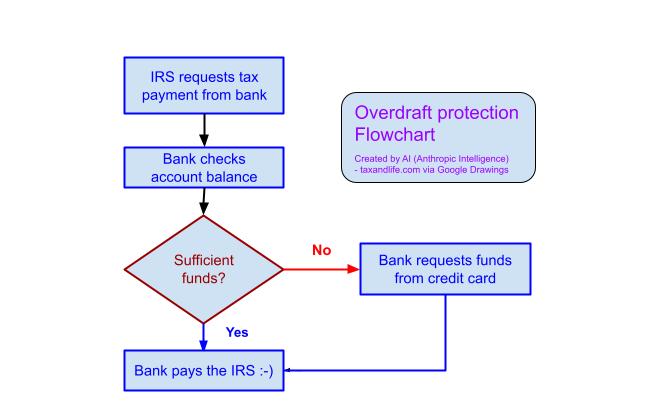

Overdraft protection is a service offered by banks. When your account balance is insufficient to complete a payment, the bank will automatically transfer funds from your linked credit card or line of credit to cover the shortfall and ensure the transaction goes through smoothly.

Without overdraft protection, if the IRS, a state tax agency, an insurance company, or another institution attempts to debit your account and there are not enough funds, the payment may be rejected. If the payee is the IRS, you may also be subject to a dishonored payment penalty:

| Payment Amount | Penalty |

|---|---|

| Below $1,250 | The lesser of $25 or the payment amount |

| $1,250 or above | 2% of the payment amount |

Beyond tax situations, rejected payments can lead to awkward moments in everyday life — such as:

- Transferring money to a personal trainer

- Sending a gift to a friend or relative

- Paying a merchant only to have the transaction fail

These situations may not involve large sums, but they affect your credibility and cause embarrassment.

Most banks charge a small fee or interest only when overdraft protection is used, with no ongoing charges. Compared to potential IRS penalties or damage to your credit, this “rescue fee” is often well worth it. Setup is also flexible — you can link a savings account, credit card, or a dedicated backup account.

Setting up overdraft protection in advance may quietly save you from a crisis when you least expect it. After all, your cash flow might fall short — but your credibility shouldn’t suffer, and penalties should definitely be avoided.

透支保护是银行提供的一项服务。当你的账户余额不足以完成付款时,银行会自动从你绑定的信用卡或信用额度账户中划款,补足差额,确保交易顺利进行。

如果没有透支保护,当税务局、州政府、保险公司或其他机构尝试从你账户中扣款时,余额不足的交易会被退回。若收款人是美国国税局,你还因此被处以一笔退票罚款:

| 付款金额 | 罚款金额 |

|---|---|

| $1,250 以下 | 罚款为 $25 或支票金额(以较小者为准) |

| $1,250 或以上 | 罚款为付款金额的 2% |

除了税务场景,日常生活中也常因付款失败陷入尴尬,比如给健身私教转账、给亲友送礼,或是向商家付款时,突然交易失败。这些场景不一定涉及大额资金,却涉及信用与面子。

多数银行在启用透支保护后,只有在实际使用时才会收取小额手续费或利息,平时并无额外费用。相比退票造成的罚款与信用影响,这笔「救急费用」可谓划算得多。配置方式也很灵活,可以绑定储蓄账户、信用卡,或专门设立的备用账户。

提前设置好透支保护,关键时刻或许就能悄悄替你解一次围。毕竟,钱可以短,信誉不能坏,罚款更不能交。