Nonresident Aliens and the 2021 Economic Impact Payment (EIP3)

Many individuals who were nonresident aliens in 2021 are now receiving the $1,400 Economic Impact Payment (EIP3), raising questions about their eligibility as well as how to handle the payment. Nonresident aliens were not eligible for EIP3 in 2021. If you receive the payment, it was issued in error by the IRS and should be returned.

The American Rescue Plan Act (ARPA) explicitly excludes nonresident aliens from receiving the EIP3. This law added Section 6428B in the Internal Revenue Code (IRC), and The IRC Section 6428B(c) defined an eligibal individual as follows:

(c) Eligible individual. For purposes of this section, the term "eligible individual" means any individual other than -

(1) any nonresident alien individual,

(2) any individual who is a dependent of another taxpayer for a taxable year beginning in the calendar year in which the individual's taxable year begins, and

(3) an estate or trust.

The IRS interpreted the law accordingly in its FAQ:

Did I qualify for the third payment if I’m a resident alien? (Updated March 25, 2022)

A person who’s a qualifying resident alien with a valid Social Security number was eligible for the payment only if he or she is a qualifying resident alien in 2021 and not claimed as a dependent of another taxpayer. A nonresident alien in 2021 wasn’t eligible for the payment. An alien who received a payment but was not a qualifying resident alien for 2021 should return the payment to the IRS by following the instructions as described in Returning the Economic Impact Payment for instructions.

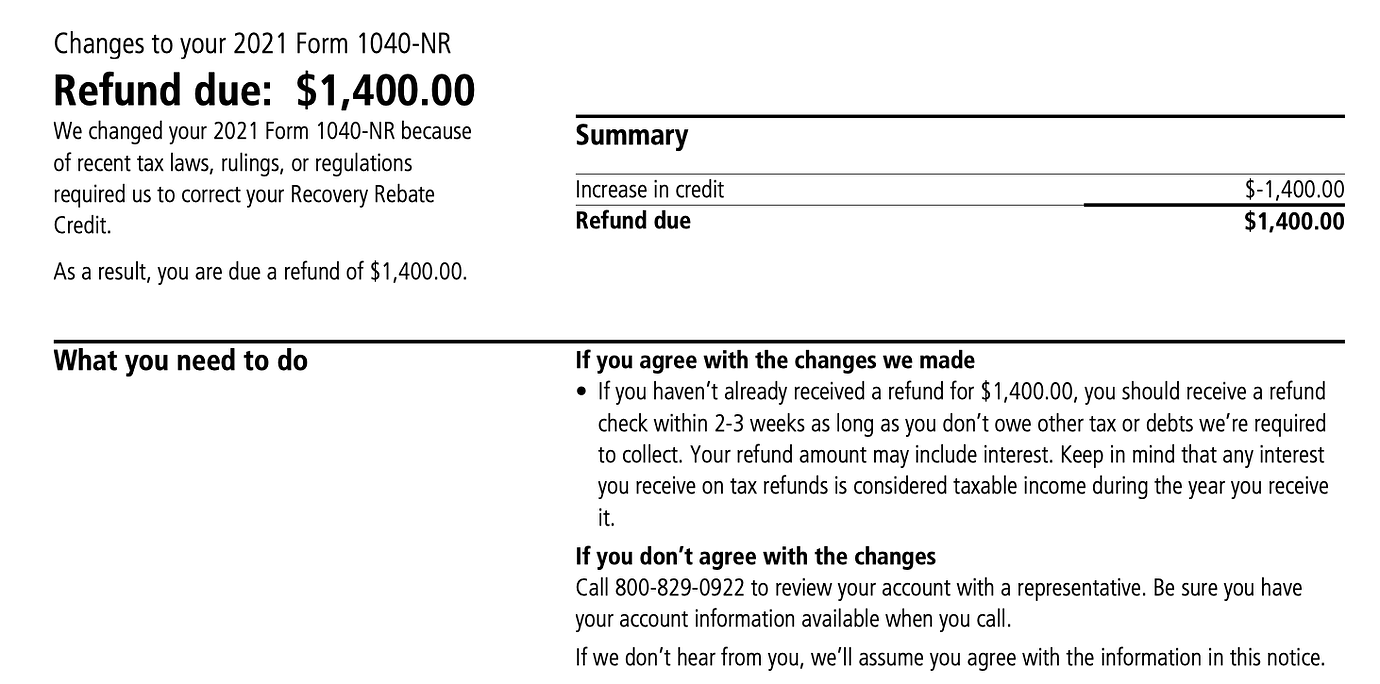

It is important to note that while the IRS is part of the executive branch of the U.S. government, it cannot change the law. The IRS may make mistakes in its execution, such as issuing payments to ineligible individuals. However, taxpayers are responsible for complying with the law. When the IRS sent the check, it included a letter asking for agreement with the change. In this case, you should not agree and instead follow the instructions to return the payment.

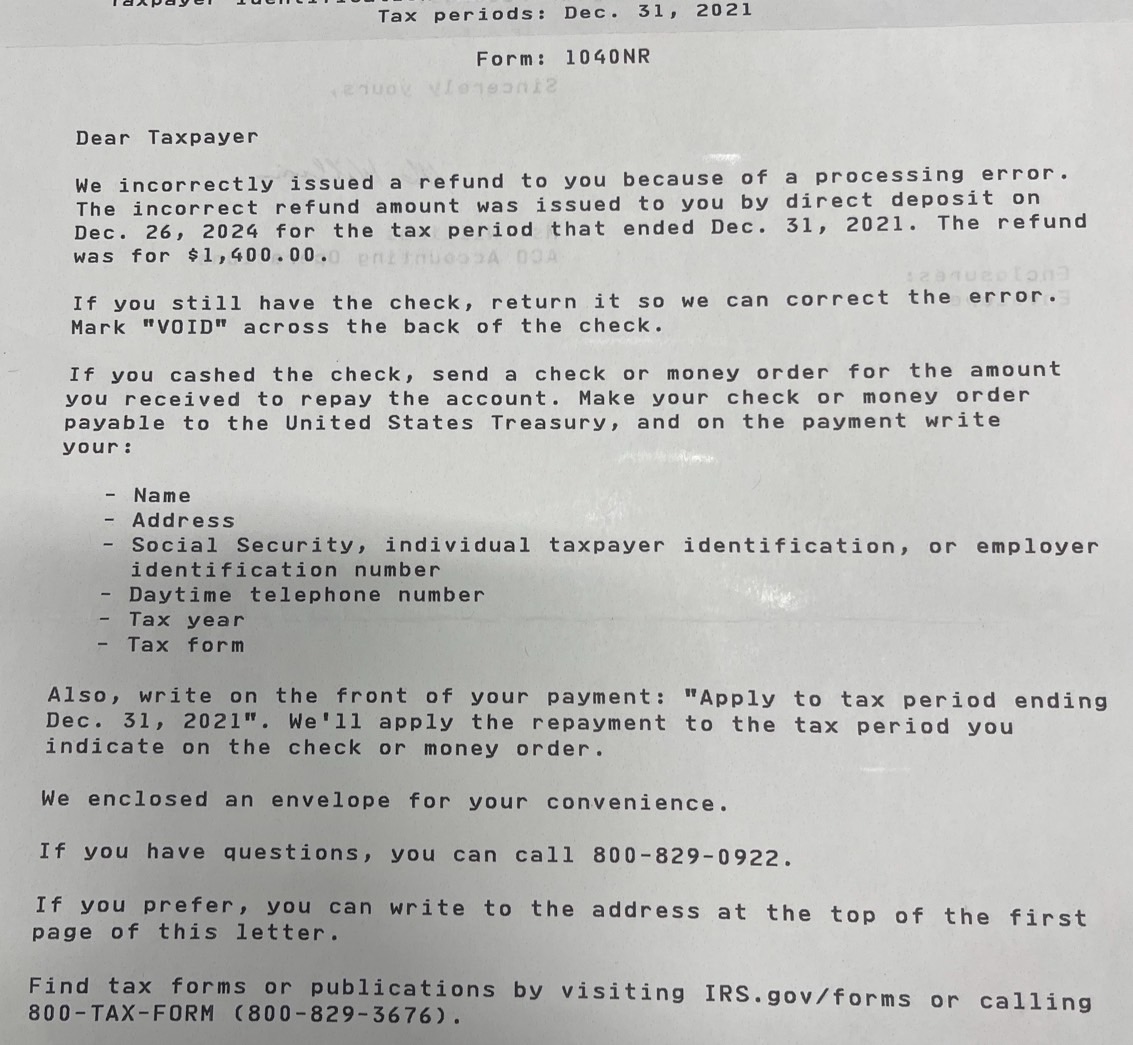

The IRS has provided specific instructions for returning a misissued EIP3:

What should I do to return an Economic Impact Payment that was received as a direct deposit or a paper check? (updated September 27, 2021)

You should return the payment as described below.

If the payment was a paper check:

- Write “Void” in the endorsement section on the back of the check.

- Mail the voided Treasury check immediately to the appropriate IRS location listed below.

- Don’t staple, bend, or paper clip the check.

- Include a brief explanation stating the reason for returning the check.

If the payment was a paper check and you have cashed it, or if the payment was a direct deposit:

- Submit a personal check, money order, etc., immediately to the appropriate IRS location listed below.

- Write on the check/money order made payable to “U.S. Treasury” and write Third EIP, and the taxpayer identification number (social security number, or individual taxpayer identification number) of the recipient of the check.

- Include a brief explanation of the reason for returning the EIP.

The IRS mailing address for returning the payment depends on where you live, and the link provided in the instructions contains a table with the appropriate locations.

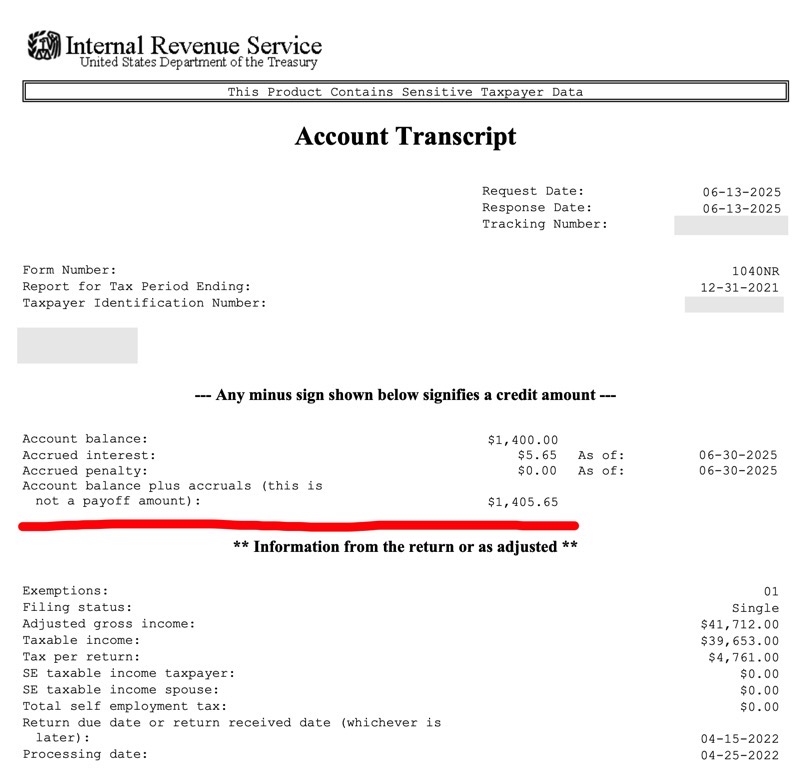

Note: This post was originally written in January 2025. As of June 2025, the IRS has begun requesting repayment of these funds, including interest:

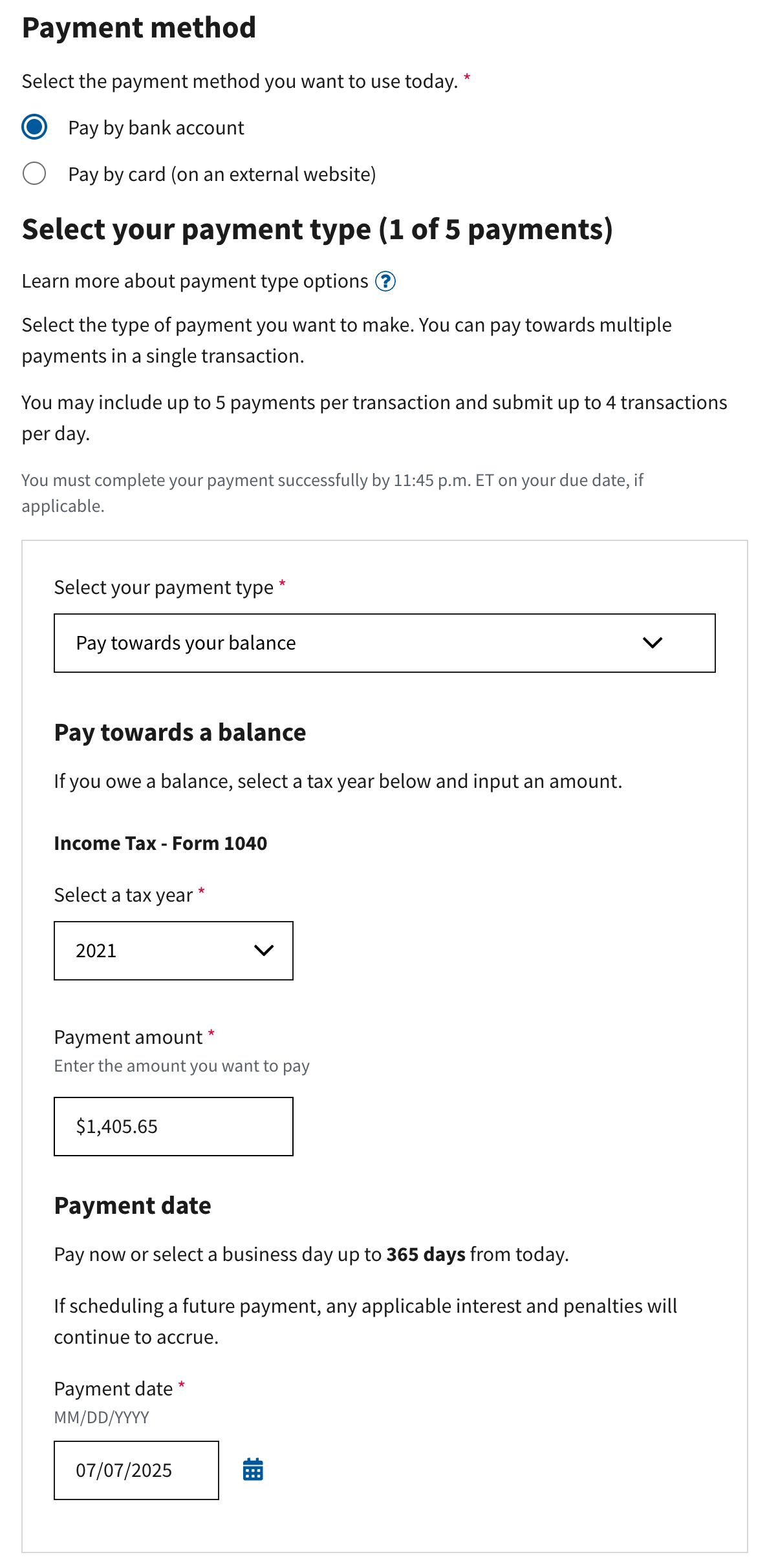

The official IRS guidance is to mail a check. However, I recommend creating an account on irs.gov if you have not already done so. If your IRS account displays a balance due, as shown below:

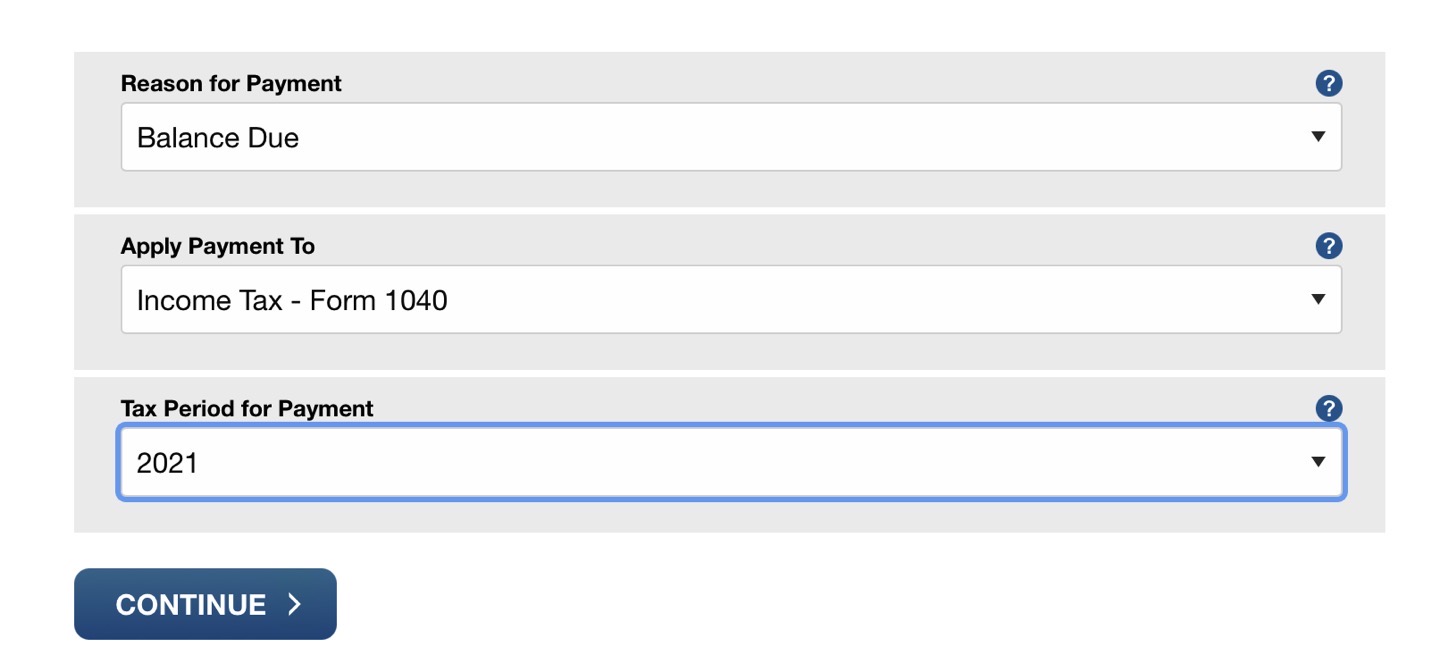

You can make a payment directly within your account:

Alternatively, you may also make a payment online without logging in:

Recaputulation:

- Pay from within your IRS account: https://sa.www4.irs.gov/ola/payment_options/make_payment

- Pay without logging in: https://www.irs.gov/payments