Other Taxes or Should I Call It High-Income Taxes?

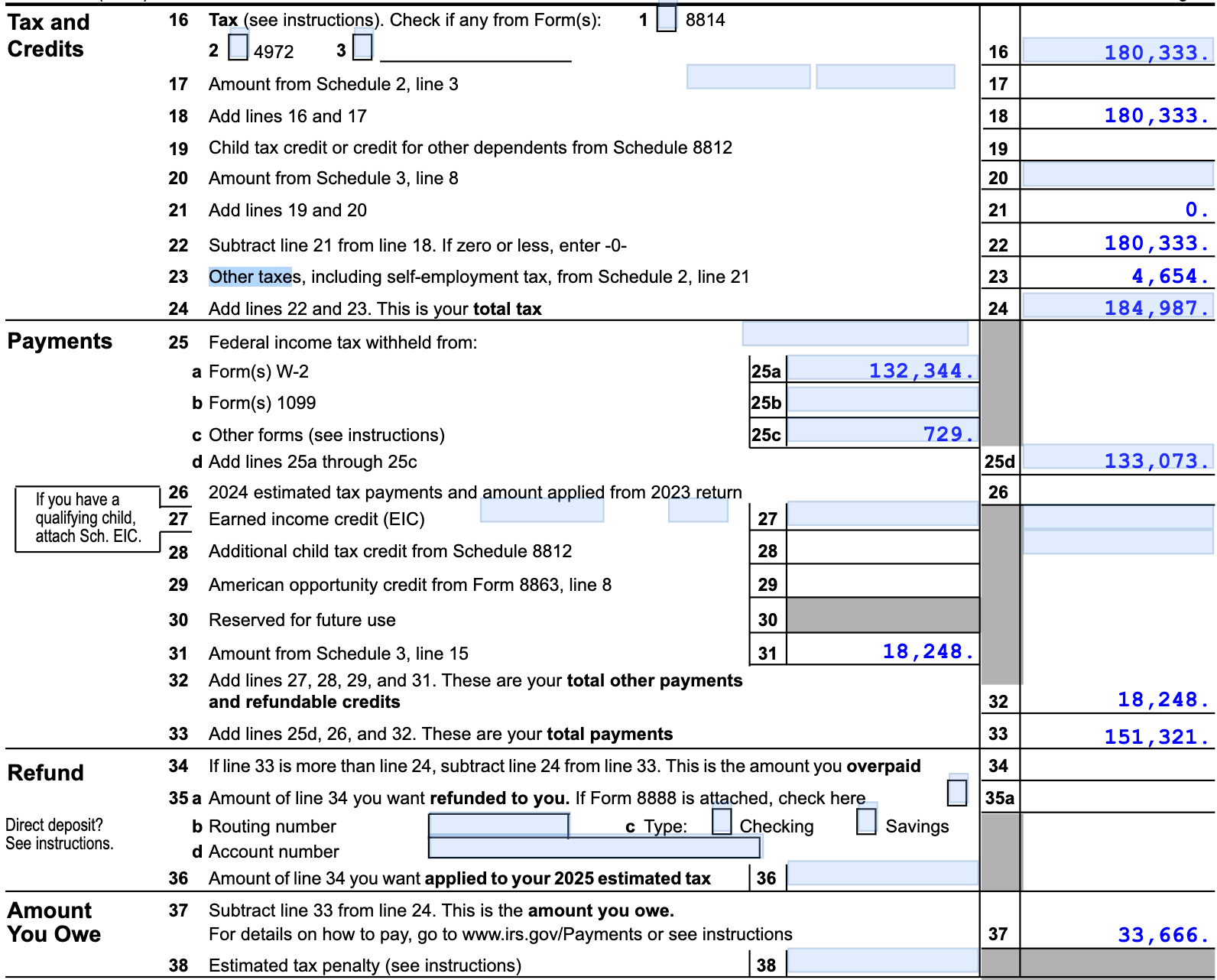

Ah, the U.S. tax system: a labyrinth that keeps tax professionals in business and the rest perpetually confused. Today, let’s dive into two delightfully ambiguous topics from your tax return — “Other Taxes” (Line 23 on the 2024 Form 1040) and Payments on “Other Forms” (Line 25c on the 2024 Form 1040).

“Other Taxes” sounds suspiciously like the IRS ran out of naming creativity. This line is reserved for those who, shall we say, find themselves on the nicer side of the income curve. If I were the IRS, I’d call it bluntly: the High-Income Taxes. As the Spaniards would say, “call bread bread and wine wine” (llamar al pan, pan y al vino, vino).

Here’s a quick breakdown of what might land here:

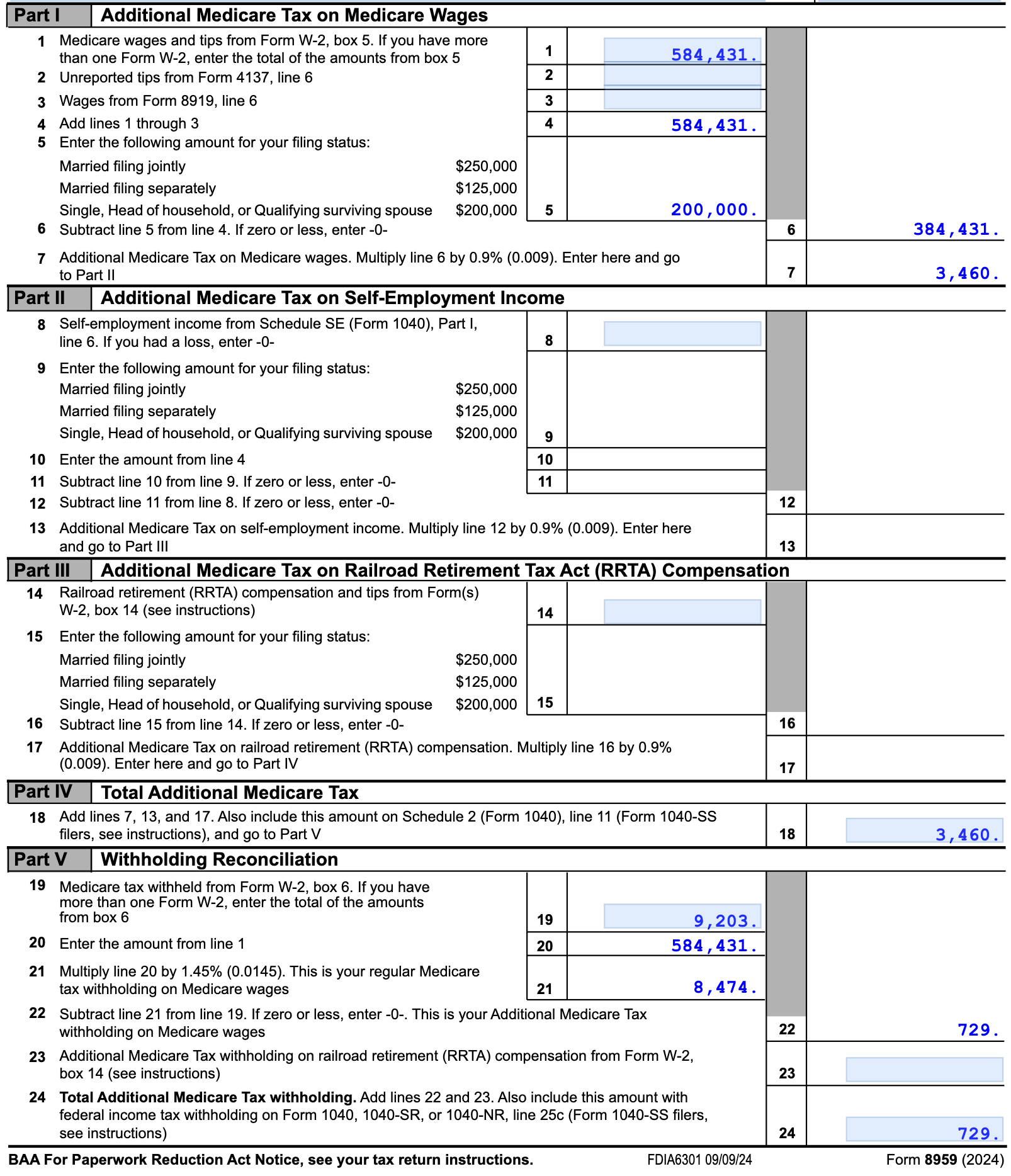

- The Additional Medicare Tax (Form 8959)

For high earners (over $200,000 for singles or $250,000 for couples), you get a special 0.9% tax on Medicare wages above those thresholds. Please note this tax only applies to wages above those thresholds, not total income, and it applies to wages, self employment income, and railroad retirement only. What’s better than being successful? Being taxed more for it! Let’s verify the math in the diagram:

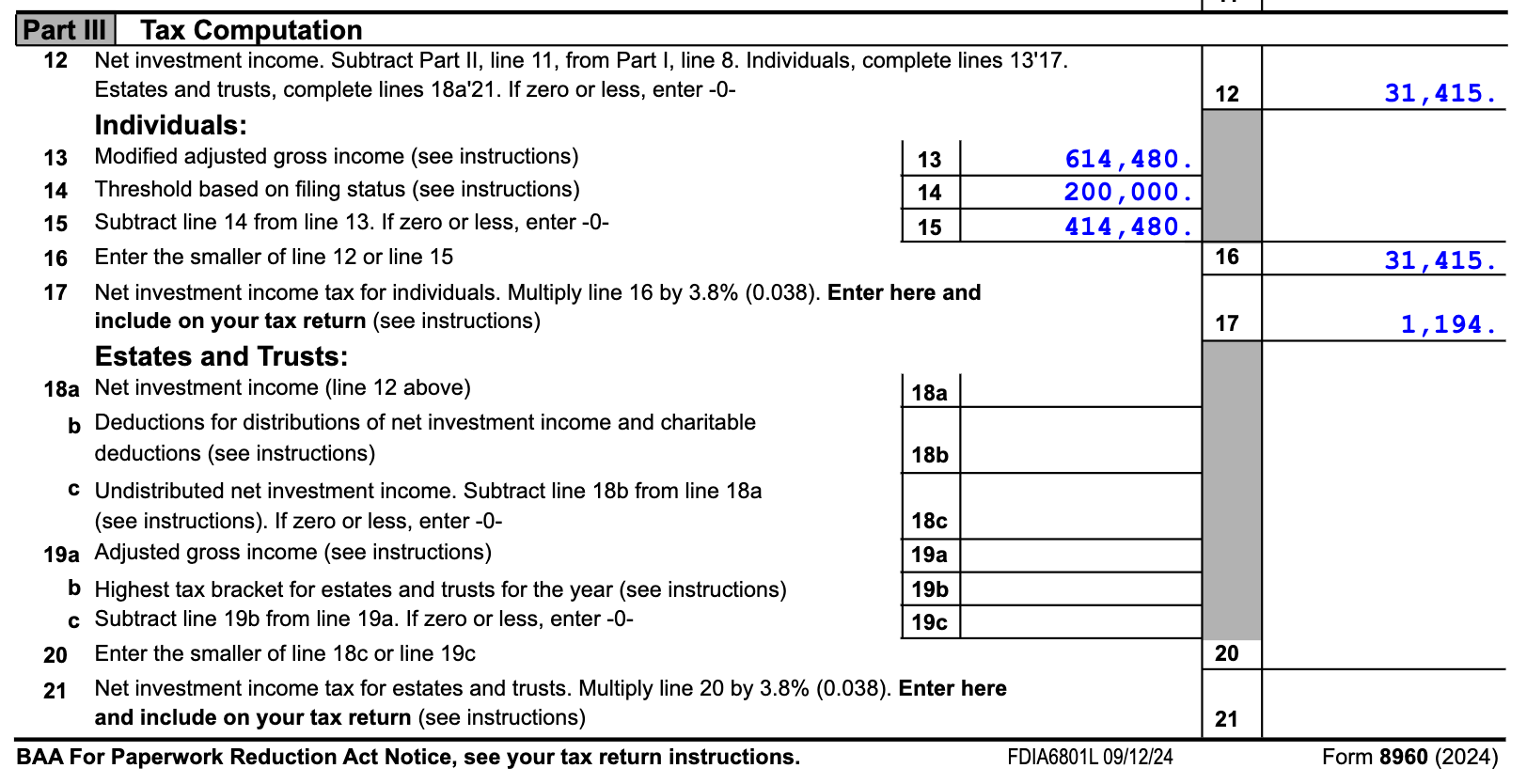

\[( \$584,431 - \$200,000 ) \times 0.9\% = \$3,460\]- Net Investment Income Tax (Form 8960)

Do you have income from interest, dividends, capital gains, or rental properties? If your Modified Adjusted Gross Income (MAGI) exceeds $200,000 ($250,000 for joint filers), the IRS wants a 3.8% cut on the investment income. In the example:

\[\$31,415 \times 3.8\% = \$1,194\]When you add the two amounts:

\[\$3,460 + \$1,194 = \$4,654\]This matches the “Other Taxes” total on Line 23 of Form 1040.

Now for Payments on “Other Forms” (Line 25c). This line represents credits or taxes you’ve already paid elsewhere. A common example is your employer might have withheld the additional 0.9% Medicare tax on your wages. See? Your employer is already playing nice with Uncle Sam. However, since your employer only knows the income they pay you, not income from other sources, the extra withholding is often less than what you owe. This is especially true if you have multiple jobs.

The credit is calculated in Part V of Form 8959 by subtracting the regular Medicare tax at 1.45% from the actual Medicare tax withheld. Let’s verify it in this example:

\[\$9,203 - (\$584,431 \times 1.45\%) = \$729\]While extra withholding is the most common example, the payment could also be from the amount withheld for the net investment income tax.

While “Other Taxes” gets all the attention because it takes from you, Line 25c often gets ignored because it gives back. Funny how nobody writes to me saying, “Hey, I think I got too much credit on Line 25c. Should we fix that?” From this observation, I derived a universal truth: tax is bad, credit is good.

Having explained the mechanical side of “other texts”, I would like to provide some historical context, which helps us understand these taxes within a larger system and provides a more hopeful outlook. The taxes on Form 8959 (Additional Medicare Tax) and Form 8960 (Net Investment Income Tax) were introduced as part of the Affordable Care Act (ACA), commonly known as Obamacare. Their purpose is to help fund Medicare and health care-related provisions under the ACA. These taxes contribute to the social good, allowing many people to obtain health insurance through Obamacare who would otherwise could not afford.