To file separately or jointly, that is not the question

Married couples often ask whether they should file taxes separately or jointly. This post explains the mechanics behind the decision.

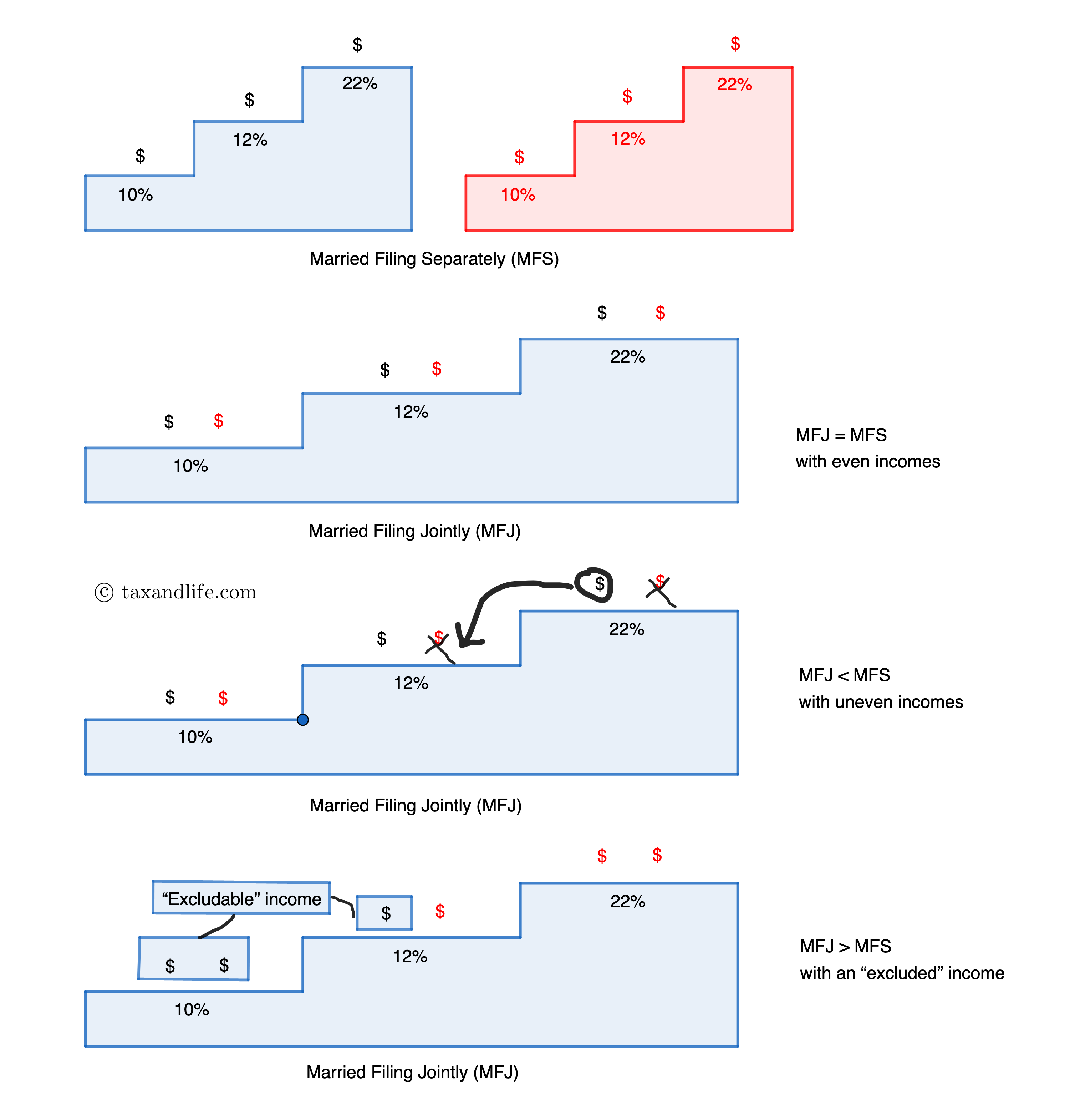

Generally, the tax brackets for joint filers are wider - often exactly double - those for separate filers. Taking the tax rate table for 2022 as an example, the 10% bracket for single or separate filers is $0 – $10,275, whereas for joint filers, it is $0 – $20,550. However, this “doubling” rule no longer holds in the highest income brackets (35% and above).

Ultimately, whether filing jointly lowers your taxes depends on “income shifting” - specifically, whether the higher-earning spouse can shift income into the lower-earning spouse’s unused lower tax brackets.

The diagram below provides an intuitive illustration.

To summarize, we can look at three common scenarios:

-

Similar Incomes: If both spouses earn roughly the same amount, the results of filing separately versus jointly are usually comparable. The combined income simply fills the doubled tax brackets, so the total tax is often similar.

-

Significant Income Disparity: If one spouse has no income or significantly lower income, the higher-earning spouse can use the unfilled lower tax brackets (the empty “stairs”) of the lower-earning spouse. This “averaging” effect reduces the couple’s overall tax liability.

Note: This benefit disappears if both spouses are high earners who have already reached the top tax bracket, because neither spouse has any “room” left on the lower stairs to share.

-

Foreign Earned Income: If one spouse utilizes the Foreign Earned Income Exclusion, the outcome depends on the net effect of two competing factors.

-

The “Push Up” Effect: Under the “stacking rule,” even though foreign income is excluded from tax, it still “occupies” the lower tax stairs. This pushes the other spouse’s income higher up the stack, potentially into a higher tax bracket than if they filed separately.

-

The “Income Shifting” Effect: Conversely, filing jointly still provides the standard benefit of wider brackets and a larger standard deduction, which can help absorb taxable income.

-

The Net Result: Whether filing jointly lowers your liability in this scenario is not automatic; it depends entirely on which factor is stronger - the penalty from being pushed into higher brackets or the savings from income shifting.

-

Beyond the simple bracket‑filling picture, here are several special cases:

-

Nonresident alien spouse.

Generally, if both spouses are nonresident aliens for the tax year, they are barred from filing jointly. However, if at least one spouse is a U.S. citizen or resident (holding a Green Card or meeting the substantial presence test) on the last day of the year, the couple can make a special election to treat the nonresident spouse as a U.S. resident for tax purposes.

The Trade-off: Deciding to make this election requires weighing two competing factors.

-

The Benefit (Income Shifting & Deductions): Filing jointly unlocks the higher Standard Deduction (which nonresidents typically cannot claim) and allows for income shifting through wider tax brackets.

-

The Cost (Worldwide Income Inclusion): In exchange, the nonresident spouse is required to report their entire worldwide income to the IRS—income that would otherwise be outside the U.S. tax net if they filed a separate nonresident return. However, the actual tax liability on this foreign income can often be partially or fully offset by utilizing the Foreign Earned Income Exclusion or the Foreign Tax Credit.

The Commitment: This election effectively subjects the couple to “worldwide taxation” and remains in effect for all future years until terminated. However, you should proceed with caution: if you ever choose to revoke this election, you generally cannot make it again. Because the decision to end the election is final and prohibits you from re-electing in the future, the initial decision should be made with great care. Please refer to this post for further details.

-

-

California mental health services tax.

California imposes an additional 1% Mental Health Services Tax on taxable income exceeding $1 million, regardless of whether a taxpayer files jointly or separately.

However, because California is a community property state, couples with a significant income disparity can sometimes benefit by electing to file separately. This allows them to split their community income between two separate returns. In an ideal scenario, the lower-earning spouse can “absorb” up to $1 million of the allocated income, potentially saving the family up to $10,000 in state taxes.

-

Liability protection and non‑tax issues.

Finally, if one spouse owes past-due child support or faces other complex liabilities, the other spouse may need to file separately to insulate themselves from that debt. Filing jointly makes both parties jointly and severally liable, meaning both are responsible for the obligation regardless of who incurred it. In such cases, the decision is a matter of legal protection rather than tax calculation.

As the saying goes, “the devil is in the details.” While this article aims to clarify the core logic, actual tax situations are often much more complex. Many tax credits and deductions are tied to specific filing statuses and income levels, so there is no simple formula or “analytic solution” that applies to everyone.

If the answer isn’t immediately obvious, theory only goes so far - it is always better to run the actual numbers. As an integral part of the return preparation process, I can generate a side-by-side comparison report (Joint vs. Separate). If the calculations show that filing separately is more advantageous, we will switch your filing status to ensure the best financial outcome.