Make a payment to extend your time to file and to pay

If you are unable to file your tax return by the due date, you may request an extension of up to six months, The IRS Topic No. 304” says. Filing an extension is a legal option and it will not have any negative impact on your chance of obtaining a green card. You can file an extension using one of the following three methods:

- Make an payment using IRS Direct Pay.

- E-file Form 4868 with a payment electronically.

- File a paper Form 4868 with a check.

Please note that while an extension by itself eliminates the larger “fail to file” penalty of 5% per month on the amount owed, it does not extend the time to pay. The “fail to pay” penalty, at 0.5% per month on the tax owed, will still apply, and interest will accrue on any unpaid amount. Therefore, it is important to make a sufficient payment with the extension to avoid penalties. Any overpayment can be refunded when you file your return - assuming, of course, before the United States files for bankruptcy.

Now, the question is how to determine the amount you owe. To answer this question, I created a Google sheets document, Simply plug in your numbers, and boom, you will get your answer.

This simply app does not consider other tax. Until it is enhanced, you should manuallu add:

- 0.9% Additional Medicare Tax on Medicare wages (Box 5 of your W-2) above $200,000 for single filers or $250,000 for joint filers.

- 3.8% of Net Investment Income Tax (NIIT) on your investment income if your Modified Adjusted Gross Income (MAGI) exceeds $200,000 (or $250,000 if married filing jointly).

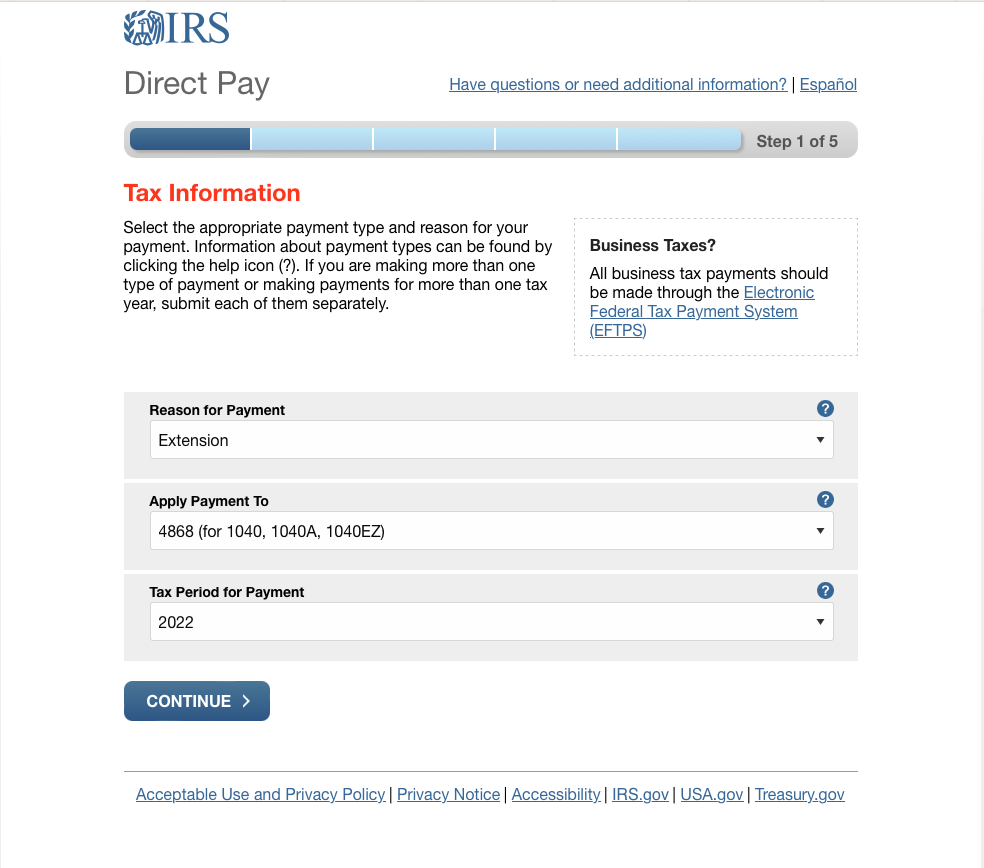

Once you know the amount, you can click the IRS Direct Pay to make an extension payment. The screen looks like the following, please select “Extention”, and current year.

If you are sure you do not owe taxes, the IRS has this to say in its document:

There is no penalty for failure to file if you are due a refund. However, you cannot obtain a refund without filing a tax return. If you wait too long to file, you may risk losing the refund altogether. In cases where a return is not filed, the law provides most taxpayers with a three-year window of opportunity for claiming a refund.

In other words, an extension to file taxes is not required if you are due a refund and do not owe any additional taxes. Filing your tax return after the regular deadline will not result in penalties or interest if you are owed a refund. However, it is still a good idea to file as soon as possible to avoid delays in receiving your refund.

In some situations, you may still want to file an extension to preserve certain rights - for example, if you need time to apply for an Individual Taxpayer Identification Number (ITIN), or if you plan to make contributions to a retirement account and want those contributions to count for the current tax year. Note, however, that IRA contributions (Traditional or Roth) must be made by the original tax deadline - typically April 15 - and not the extended deadline. Only certain plans, such as SEP IRAs or Solo 401(k)s, may allow contributions up to the extended deadline if the plan was established on time and an extension was filed.

State taxes can be estimated similarly to federal taxes, but you should review the tax laws specific to your state. I do not have a spreadsheet calculator for each state, but as a rough estimate, you can multiply your state taxable income by the highest marginal tax rate in your state, then subtract any state income tax already withheld or paid.

For your convenience, the table below lists the highest tax rate and payment URL for each state, as well as the District of Columbia and the United States (federal government).

| Tax authority | Highest Rate | Payment URL |

|---|---|---|

| United States | 37% | https://www.irs.gov/payments/direct-pay |

| Alabama | 5% | https://www.revenue.alabama.gov/payments/ |

| Alaska | 0% | https://online-tax.alaska.gov/ |

| Arizona | 4.5% | https://www.aztaxes.gov/Home/PaymentOptions |

| Arkansas | 6.6% | https://atap.arkansas.gov/pay-and-file/individual/ |

| California | 13.3% | https://www.ftb.ca.gov/pay/index.html |

| Colorado | 4.55% | https://www.colorado.gov/revenueonline/_/ |

| Connecticut | 6.99% | https://portal.ct.gov/DRS/Payments-and-Credits/ |

| Delaware | 6.6% | https://revenue.delaware.gov/individuals/ |

| District of Columbia | 8.95% | https://otr.cfo.dc.gov/page/payments |

| Florida | 0% | https://floridarevenue.com/Pages/default.aspx |

| Georgia | 5.75% | https://dor.georgia.gov/pay-individual-income-tax |

| Hawaii | 11% | https://www.hawaii.gov/tax/ |

| Idaho | 6.925% | https://tax.idaho.gov/i-1143.cfm |

| Illinois | 4.95% | https://www2.illinois.gov/rev/Pages/Payments.aspx |

| Indiana | 3.23% | https://www.in.gov/dor/3852.htm |

| Iowa | 8.53% | https://tax.iowa.gov/individual/income-tax-payment-options |

| Kansas | 5.7% | https://www.kdor.ks.gov/Apps/kcsc/login.aspx |

| Kentucky | 5% | https://revenue.ky.gov/Pages/Individual.aspx |

| Louisiana | 6% | https://esweb.revenue.louisiana.gov/OnlineTaxPayments/ |

| Maine | 7.15% | https://www.maine.gov/revenue/netfile/gateway2.htm |

| Maryland | 5.75% | https://taxes.marylandtaxes.gov/Individual_Taxes/ |

| Massachusetts | 5% | https://www.mass.gov/how-to/pay-your-personal-income-tax |

| Michigan | 4.25% | https://www.michigan.gov/taxes/0,4676,7-238-43519—,00.html |

| Minnesota | 9.85% | https://www.revenue.state.mn.us/payments |

| Mississippi | 5% | https://www.dor.ms.gov/Pages/Individual.aspx |

| Missouri | 5.4% | https://dor.mo.gov/individual/individual/payments.php |

| Montana | 6.9% | https://app.mt.gov/epayments/individual |

| Nebraska | 6.84% | https://www.revenue.nebraska.gov/Payment.html |

| Nevada | 0% | https://www.nevadatax.nv.gov/Payment/PaymentHome.aspx |

| New Hampshire | 5% | https://www.revenue.nh.gov/payments/index.htm |

| New Jersey | 10.75% | https://www.state.nj.us/treasury/taxation/payments/ |

| New Mexico | 5.9% | https://www.tax.newmexico.gov/pay-taxes/ |

| New York | 8.82% | https://www.tax.ny.gov/pay/all/payments.htm |

| North Carolina | 5.25% | https://www.ncdor.gov/taxes-forms/payments |

| North Dakota | 2.9% | https://www.nd.gov/tax/user/businesses/formslinks |

| Ohio | 4.797% | https://tax.ohio.gov/wps/portal/gov/tax/home |

| Oklahoma | 5% | https://www.ok.gov/tax/Individuals/Pay_Online.html |

| Oregon | 9.9% | https://www.oregon.gov/DOR/Pages/payments.aspx |

| Pennsylvania | 3.07% | https://www.revenue.pa.gov/OnlineServices/Padirect/ |

| Rhode Island | 5.99% | https://www.ri.gov/taxation/Business/ |

| South Carolina | 7% | https://dor.sc.gov/tax/pay-taxes |

| South Dakota | No state tax | N/A |

| Tennessee | 6% | https://www.tn.gov/revenue/taxes/pay-online.html |

| Texas | No state tax | N/A |

| Utah | 4.95% | https://tap.utah.gov/TaxExpress/_/ |

| Vermont | 8.75% | https://tax.vermont.gov/payments |

| Virginia | 5.75% | https://www.tax.virginia.gov/payment-options |

| Washington | No state tax | N/A |

| West Virginia | 6.5% | https://tax.wv.gov/Pages/OnlineServices.aspx |

| Wisconsin | 7.65% | https://www.revenue.wi.gov/Pages/OnlineServices/home.aspx |

| Wyoming | No state tax | N/A |