Refundable and nonrefundable credit explained

Refundable and non-refundable credits refer to different types of tax credits that can be claimed on an individual’s federal tax return.

Refundable tax credits, such as the Earned Income Tax Credit (EITC) and the Child Tax Credit, can be refunded to the taxpayer even if they have no tax liability, that is, they can get the credit “for free”. If the value of the credit is greater than the taxpayer’s tax bill, the taxpayer will receive a refund for the difference.

On the other hand, non-refundable tax credits, such as the Foreign Tax Credit, can only reduce the taxpayer’s tax liability to zero but cannot result in a refund. If the value of the credit is greater than the taxpayer’s tax bill, the excess amount is not refunded to the taxpayer.

These jargons enter public domain when The IRS published information on the new electronic vehicle credit on this website:

The maximum credit is $7,500. It is nonrefundable, so you can’t get back more on the credit than you owe in taxes.

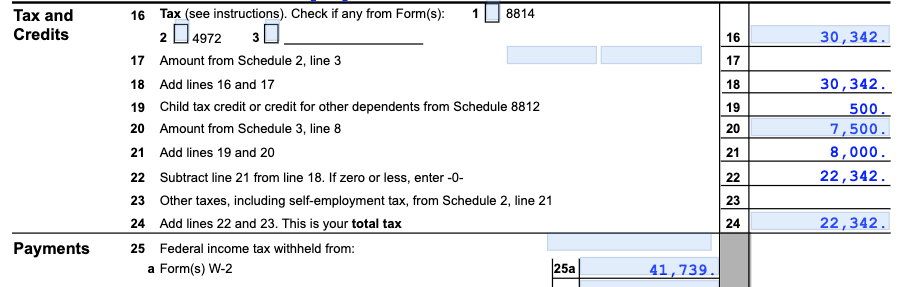

More than one client has asked me if they should reduce withholding to make sure that they owe more than $7,500. No, it’s not necessary. What the IRS meant was that the credit can only be used to offset your tax liability based on your income and applicable tax laws, after taking into account any tax credits or deductions you are eligible for, but before taking into account the tax withholding, as shown below:

This prevents people from taking the credit for free. For example, if someone has no income, they cannot take the credit at all. If someone has $9,000 in taxable income and their tax liability is $900, then they can only use the credit to offset the tax liability to zero, and will lose the rest of the credit.