Tax notes: Long term capital gain tax explained

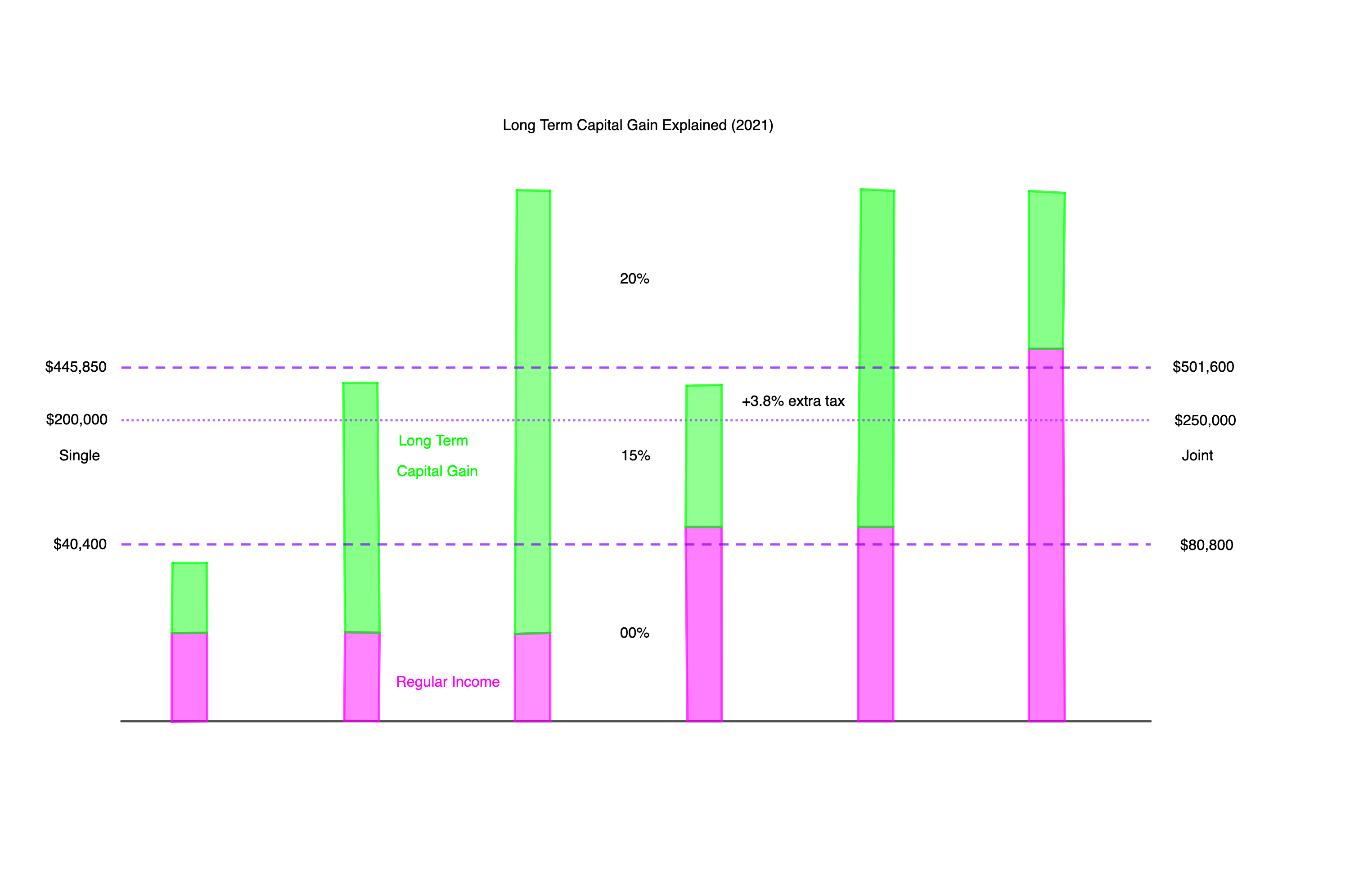

Recently, the long term capital gain has gained much attention because Biden administration is planning to increase the tax rate (However, the proposal did not succeed.) The following diagram shows how the long term capital gain is taxed currently in all 6 base income and long term capital gain combinations. The short term is taxed as ordinary income.

The qualified dividend ix taxed the same as long term capital gain. A qualified dividend is a dividend paid by a U.S. corporation or a qualified foreign corporation that is held for at least 61 days during the 121-day period that begins 60 days before the ex-dividend date.

In the discussion below, please consider the term long term capital gain to include qualified dividend.

In case it is not super clear, here are the steps to compute the long term capital gain tax:

- Draw your regular income (wage, short term, etc. shown in pink in the digram)

- On top of it, draw your long term capital gain (including qualified dividend)

- Draw the dividing line between 0% and 15% long term capital gain rate which can be found in wikipedia

- Draw the dividing line between 15% and 20% long term capital gain rate

- You pay tax at x% rate for the capital gain in the x% region (if you have $1 in 20% region, then you just pay 20% on that $1)

- High income individuals (single with adjusted gross income $20,000, joint $250,000) will pay “Net Investment Income Tax”, or NIIT, on form 8960.

The House bill proposed to change the 20% rate to 25%, and slight lower the threshold ($400,000 for singles and $450,000 for married couples) according to cnbc.

Assuming the new rate is effective from 2022, the question is to sell (and buyback) or not to sell.

Let us compare two situations. When you sell the stock, you will pay tax on the gain “D”. In order to compare apple to apple, we need to invest the same amount in “not to sell” situation. Suppose the total growth rate is “i” when you finally sell it, you break even if the take home gain makes up the more tax paid. Suppose you are at the top rate, the break even point reached when:

Solve this equation, we get:

I believe this answered the question.