Dual status taxpayer and recovery rebate credit

What about dual status?

One files as dual status when her status changes from nonresident to resident. A common case is a status change from F-1 to H-1B in October. This person would normally file as nonresident because the number of days as a resident did not exceed 183 days, however, she could file a dual status return by electing first year choice if doing so is more advantageous. Claiming the recovery rebate credit is such an advantage, the question is: does a dual status taxpayer qualify for recovery rebate credit?

The IRS says in this link:

Generally, if you were a U.S. citizen or U.S. resident alien in 2020, were not a dependent of another taxpayer and have a Social Security number that is valid for employment, you are eligible for the Recovery Rebate Credit.

It continues to say who is not eligible:

You are not eligible for the Recovery Rebate Credit if any of the following applies:

- You may be claimed as a dependent on another taxpayer’s 2020 return (for example, a child or student who may be claimed on a parent’s return or a dependent parent who may be claimed on an adult child’s return).

- You do not have a Social Security number that is valid for employment issued before the due date of your 2020 tax return (including extensions). Some exceptions apply for those who file married filing jointly where only one spouse must have a valid Social Security number to claim RRC.

- You are a nonresident alien.

- You are an estate or trust.

The IRS did not provide a straight answer, but no answer does make the question disappear. As a tax professional, I am facing real clients with this real question, so I have to use my logic to come up with an answer and support it, and my answer is resounding YES.

Here is my reasoning:

- The CARES and CAA only says a resident with a valid social security number, but did not require a full year resident. A dual status person who is a nonresident status in the beginning of year and a resident in the end of the year has become a resident. As a comparison, a person who is married at the end of year is considered as married for the full year.

- A dual status return has a myriad of restrictions, but not being able to claim recovery rebate credit is not in the list.

- Technically a dual status person which is a resident at the end of year files resident return, while the form 1040-NR or the other form of documentation simply serves as a statement.

“Everything which is not forbidden is allowed.” It is safe to claim recovery rebate credit, as the IRS cannot find a reason to reject your claim.

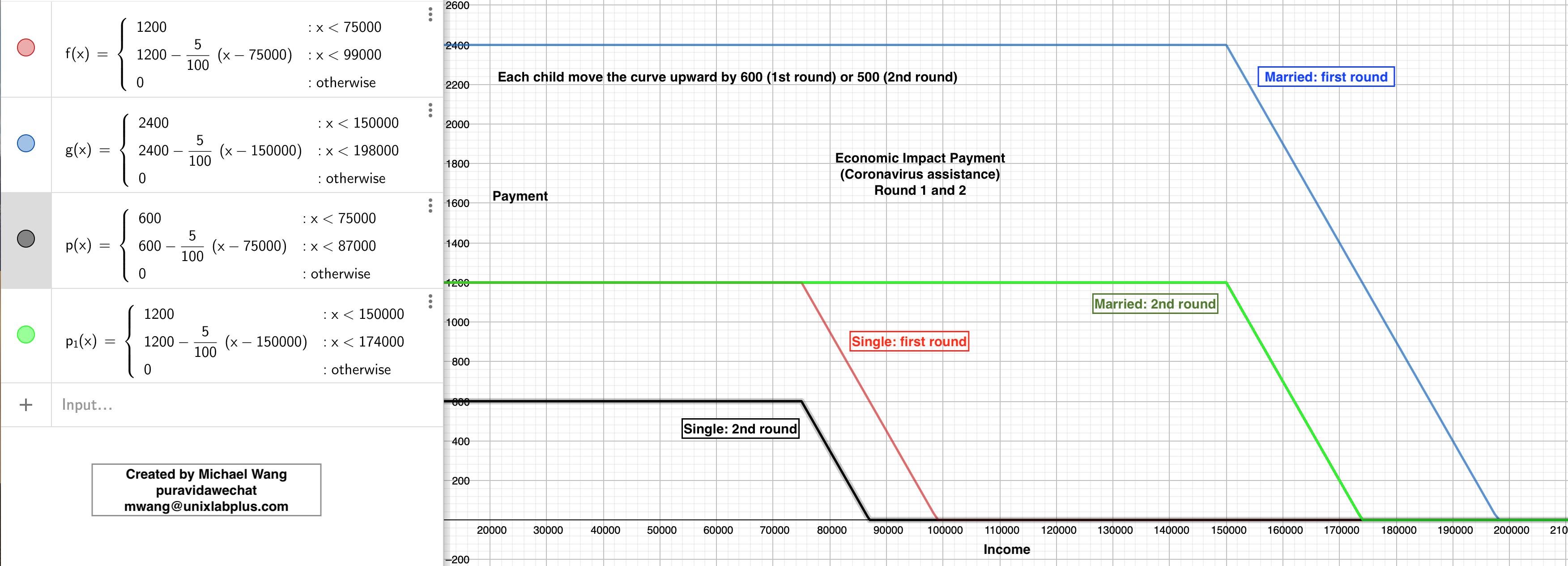

While the legal aspect is cleared, there is still an economic one. If you make too much, then you would not qualify due to the income level. It is too bad but you would not have my sympathy.