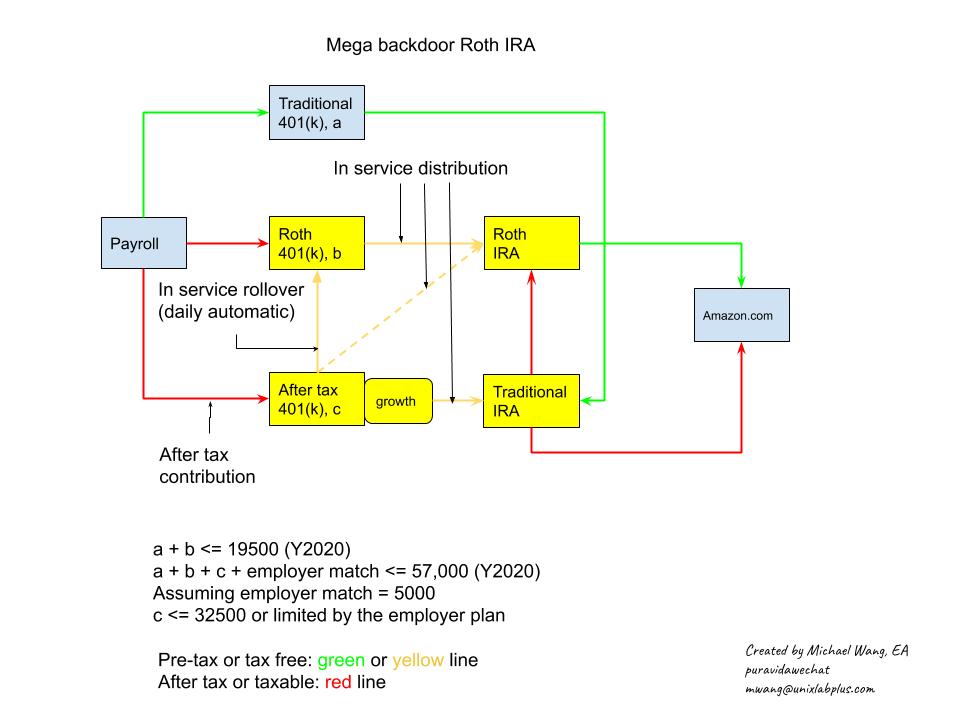

Mega backdoor Roth IRA

Mega backdoor Roth conversion is a 401(k) plan that, as shown in diagram, consists of:

- after tax contribution

- in service distribution

- in service rollover

It starts with after tax contribution, which allows you to contribute a large amount of money to after tax 401(k). If in service rollover is available, you can setup daily automatic rollover from after tax 401(k) to Roth 401(k), and then optionally convert to Roth IRA. If in service rollover is not available, you can periodically converts the principal to Roth IRA, the growth to traditional IRA.

You should convert the after tax 401(k) to either Roth 401(k) or Roth IRA as soon as possible to allow tax free growth. Converting to Roth IRA provides an additional flexibility to withdraw the principal tax free due to the “5 year rule”: you can withdraw the principal amount (not the growth) tax free 5 years after the conversion. Please note that a separate 5-year period applies to each conversion and rollover.

Mega back door Roth conversion is offered only by a selected few Silicon Valley companies such as Amazon and Facebook. If your company does not love you that much, you can always go through the basic backdoor.